Company

Corporate Governance

Basic Approach

Central Glass regards the continuous enhancement of overall management transparency and fairness as a fundamental principle of its corporate governance. An equally important principle is the ability to respond swiftly to changes in the business environment by establishing an agile and efficient decision-making structure, all in pursuit of sustainable growth and the enhancement of corporate value.

Our company complies with all the principles of the Corporate Governance Code.

Efforts to Enhance Corporate Governance

| From 2000 | From 2010 | From 2020 |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

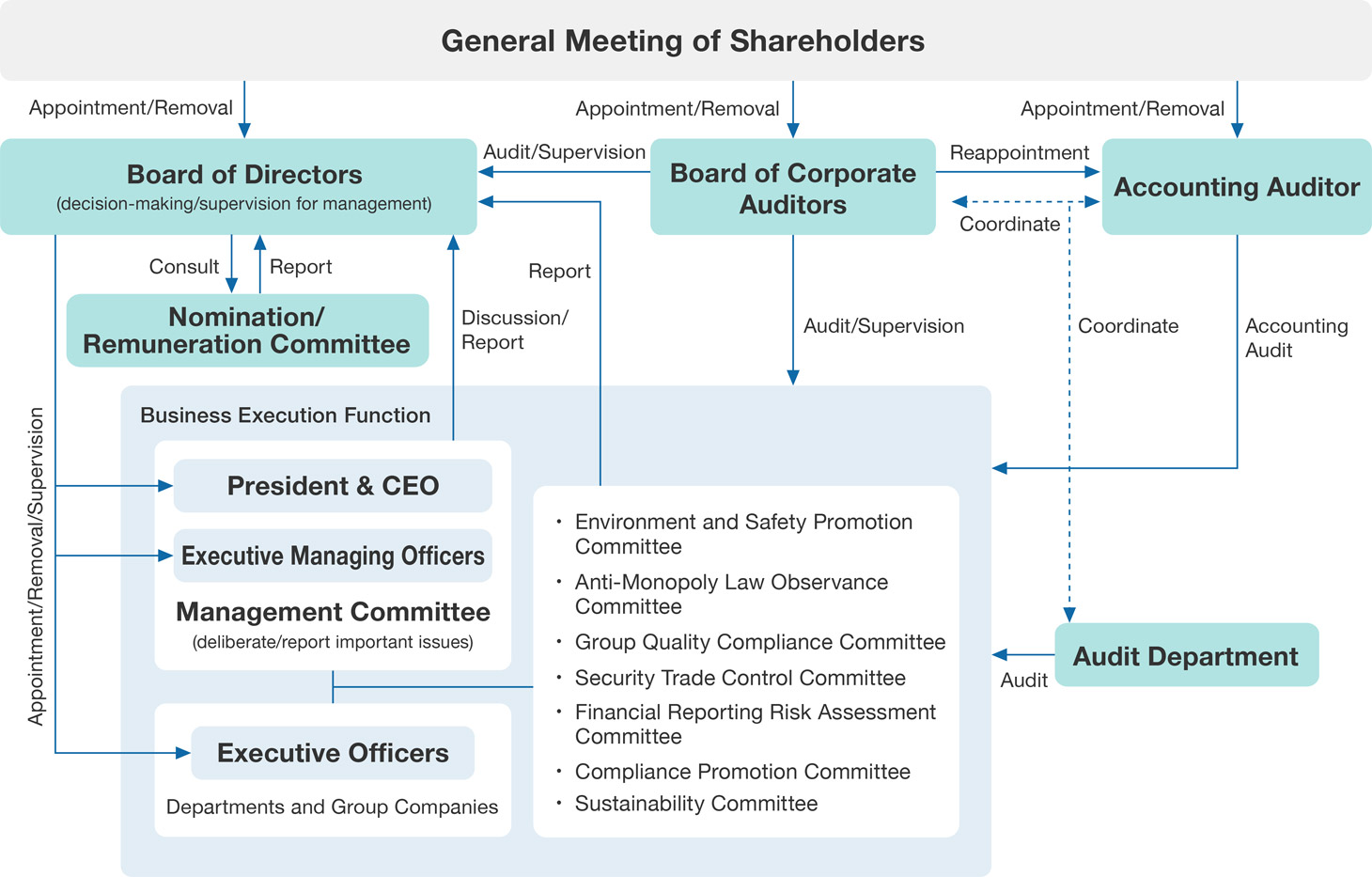

Corporate Governance System

Structure Diagram

Basic System

In 2004, we introduced an executive officer system to separate the Board of Directors’ roles—making key management decisions and overseeing business execution—from the actual day-to-day business operations, thereby enhancing overall management efficiency. In 2019, we established a Nomination and Remuneration Committee with a majority of Independent Outside Directors to enhance the transparency, fairness, and objectivity of procedures related to the nomination and remuneration of Directors. Furthermore, based on a resolution of the Ordinary General Meeting of Shareholders held in June 2025, we transitioned from a company with a Board of Corporate Auditors to one with an Audit and Supervisory Committee. As a result, the Board of Directors now includes individuals who are members of the Audit and Supervisory Committee, thereby strengthening its monitoring and supervisory functions. At the same time, a portion of decision-making authority related to business execution has been delegated to Directors (specifically, the Representative Director, President & CEO), allowing for more agile and efficient decision-making. Additionally, the majority of the Board of Directors (including Audit and Supervisory Committee members) consists of Independent Outside Directors, reinforcing a Corporate Governance system that ensures greater management transparency and fairness.

Overview of the System (as of June 27, 2025)

*(Number of women)

| Item | Headcount, etc. |

|---|---|

| Organizational Structure | Company with Audit and Supervisory Committee |

| Number of Directors | 10(2) |

| Number of Outside Directors | 6(2) |

| Number of Directors who are Audit and Supervisory Committee members |

4(1) |

| Number of Outside Directors | 3(1) |

| Term of office of Directors | 1 year (Directors who are Audit and Supervisory Committee members: 2 years) |

| Executive Officer System | Yes |

Board of Directors

The Board of Directors consists of 10 persons (including 6 Outside Directors). As a rule, the Board of Directors meets at least once a month, and when necessary, to deliberate and resolve legal and important managerial issues in line with the Company regulations covering the Board of Directors, and supervises the execution of business by Executive Officers including the President & CEO.

Management Committee

The Management Committee is composed of 11 Executive Officers, and meets once a week, as a rule, in line with the Management Committee Regulations. It deliberates important issues affecting the execution of business, which are then decided by the President & CEO. It also deliberates proposals to be put forward to the Board of Directors.

Audit and Supervisory Committee

The Audit and Supervisory Committee consists of 4 persons (including 3 Outside Audit and Supervisory Committee members). As a rule, the committee meets once a month, or whenever necessary, to deliberate and resolve important auditing issues. The members regularly exchange opinions to build an efficient and effective audit system. In addition, to deepen mutual understanding between the Representative Director and Audit and Supervisory Committee members, they regularly meet and exchange opinions on important management and auditing issues.

In accordance with the auditing standards established by the Audit and Supervisory Committee, the members of that committee attend important meetings, including Board of Directors meetings. They audit the execution of duties by Directors and Executive Officers, along with the status of business execution at each division and subsidiary of Central Glass, with the aim of enhancing audit effectiveness.

Nomination and Remuneration Committee

Central Glass has established the Nomination and Remuneration Committee as a voluntary advisory body to the Board of Directors. It has been established to further enhance our Corporate Governance system by strengthening the transparency, fairness, and objectivity of the Board of Directors’ functions with respect to the nomination and remuneration of Directors and Audit and Supervisory Committee members. The committee comprises at least three members, with a majority being Independent Outside Directors (including Outside Audit and Supervisory Committee members), and at least one member being the Representative Director. The committee chair is selected by resolution of the committee from among the Outside Directors (including Outside Audit and Supervisory Committee members).

Diversity of Executives (Skill Matrix)

In alignment with our Long-Term Vision, VISION 2030, and our aspiration to Be a Specialty Materials Company contributing to the realization of a sustainable society,” we have identified the following skill areas as those expected of our Directors. The aim is to ensure agile and efficient decision-making on key management issues and proper oversight and supervision of business execution.

The necessary skills for Directors will be reviewed as necessary in accordance with our management strategies.

| Title | Name | Gender | Skills expected of Directors | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate management | Finance & Accounting | Legal & Compliance | Internationality | Sustainability | Sales & Marketing | Technology & R&D | DX | ||||

| Directors (excluding Directors who are Audit and Supervisory Committee members) | Inside | Kazuhiko Maeda |

Male | ● | ● | ● | ● | ● | ● | ||

| Tetsuo Kanai |

Male | ● | ● | ● | ● | ● | |||||

| Akihiro Ishii |

Male | ● | ● | ● | |||||||

| Outside | Masaya Kawata |

Male | ● | ● | ● | ||||||

| Shiori Ishihara |

Female | ● | ● | ||||||||

| Keikou Terui |

Male | ● | ● | ● | |||||||

| Directors who are Audit and Supervisory Committee members | Inside | Masanori Murata |

Male | ● | ● | ||||||

| Outside | Toshihide Nishimura |

Male | ● | ● | |||||||

| Toshifumi Mikayama |

Male | ● | ● | ● | |||||||

| Masako Goto |

Female | ● | ● | ● | |||||||

- Please note that the skills listed for each Director do not represent the full range of knowledge or experience possessed by each individual.

Cross-Shareholdings

Policy on the Reduction of Cross-Shareholdings

Our Company conducts an examination into the appropriateness of the purpose of cross-shareholdings listed shares as well as whether benefits and risks resulting from holding them worth the capital cost according to individual issues. We also consider selling of shares that do not contribute to the medium- to long-term improvident of our Company’s enterprise value, promoting the reduction of cross-shareholdings. However, comprehensively considering non-financial aspects such as management strategies and measures against risks from the perspective of the maintenance and strengthening of partnerships, transactional relationships and business relationship, we plan to hold listed shares that will contribute to the medium- to long-term improvement of our Company’s enterprise value.

Based on the above policy, the Board of Directors conducts an examination on cross-shareholdings listed shares, and will continue to conduct a review regularly.

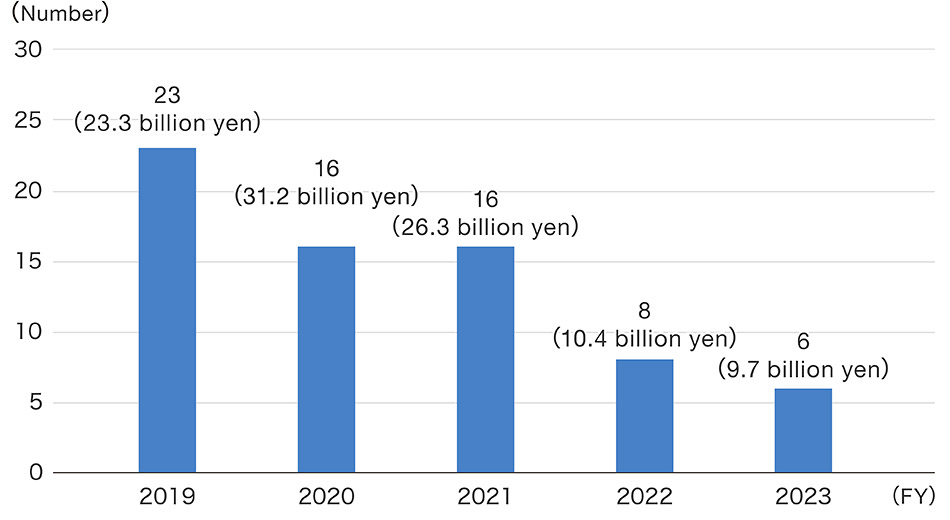

Trends in cross-shareholdings (number of issues and book value at the end of the period)